LANGUAGE↓

News & Policies

Profit Repatriation: Limits and Tax Considerations in China

For foreign companies with subsidiaries in China, profit repatriation from their subsidiaries has always been an important and challenging issue. China maintains a strict system of foreign exchange controls, meaning funds flowing into and out of China are tightly regulated. It is important for foreign investors to incorporate a profit repatriation strategy into the set-up planning of a subsidiary in China to ensure its ability to access the profits earned and to achieve significant cost savings.

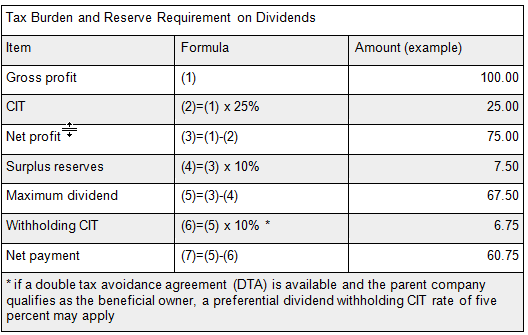

There are several ways to repatriate profit from China, the most obvious being for a company’s China-based entity to pay dividends directly to its foreign parent company. However, this is subject to certain prerequisites – only profits that have undergone annual audit can be repatriated using this channel, ensuring that the gross profit will be subject to 25 percent CIT. Dividends are subject to a further 10 percent withholding CIT when distributed to foreign investors.

Further, a foreign-invested enterprise (FIE) can only distribute dividends out of its accumulated profits, which means that its prior accumulated losses must be more than offset by its profits in other years, including the current year. An FIE must also place 10 percent of its annual after-tax profits into a reserve fund until it reaches 50 percent of the FIE’s registered capital. The chart below illustrates the tax burden and reserve requirements applicable to dividends in China before they can be remitted abroad.

Based on the above constraints, many multinational corporations have adopted certain implicit policies, such as minimizing their profits in China in a legitimate manner via intercompany payments, i.e., charging their Chinese entity royalty or service fees.

Although these transactions will be subject to turnover tax, and possible withholding CIT, the fees are deductible from the CIT taxable income and thus are exempt from the 25 percent CIT, resulting in significant cost savings.

Above is just a brief information regarding profit repatriation in China. Should you have further question, please do not hesitate to contact us.